Possible business models for H2

Possible business models for H2

This blog is inspired by the paper published by H. Hansson in the International Journal of Hydrogen Energy.¹

In this blog, we aim to contribute to answering the question of who are the actors in the hydrogen value chain ecosystem that must adapt their business models by 2045 if they want to continue being relevant.

Main actors in the hydrogen value chain ecosystem

Narrowing down to the hydrogen road transport market, the main market actors in the hydrogen road transport value chain ecosystem by 2025 consist of (non-exhaustive):

- Producers of renewable electricity from eolic and solar energy.

- Hydrogen producers. Water electrolysis seems to be the most promising mass-production technology.

- Suppliers of hydrogen. A specialized group of companies who facilitate to end-users the availability of hydrogen.

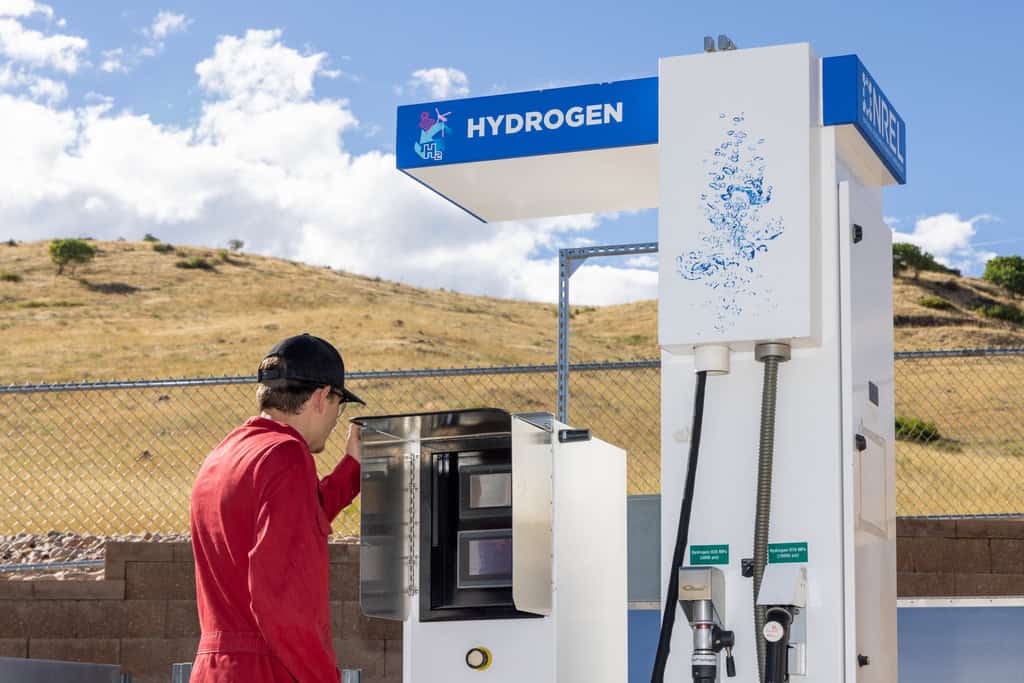

- Hydrogen refueling station owners. National or multinational companies, in many cases, gasoline and diesel companies, are the natural first movers at this point.

- Hydrogen end-users. Consumers of hydrogen. In this blog, we focus mainly on heavy-duty road vehicles and long-haul transport.

- Vehicle manufacturers. If the trend of owning a personal vehicle continues, we can expect to see more brands and bigger research and engineering efforts to produce more hydrogen-powered personal vehicles.

- Vehicle service companies. It includes specialized personnel for servicing and supporting the use of heavy-duty road vehicles, personal vehicles, and long-haul transport

- Newcomers. This includes existing and non-existing companies that see new business opportunities with the new trends.

Prioritizing scalability in research and development

Today, in 2025, many of these market actors will benefit from direct or indirect subsidies from different policies and government levels. In EU wording, it is called “Coordinated EU research and innovation support” and is needed for large-scale, high-impact projects across the entire hydrogen value chain, enabling the test technology to be used in a real-life environment.² There are some strategic and governing documents paving the way, for example, IEA – Future of Hydrogen³, European Commission – A Hydrogen Strategy for a Climate-neutral Europe², Renewable Energy Directive⁴, Hydrogen Energy Network⁵, Hydrogen Roadmap Europe⁶, EU regulation for Deployment of Alternative fuels infrastructure⁷ and National Energy and Climate Plans.

In the mentioned paper¹ and in a previous report⁸, the authors identified four key future business conditions to take into account during the process of adapting business models for the forthcoming hydrogen market demands.

Future expected business conditions

Net-Zero CO2. Hydrogen production will be completely decarbonized; there will be only what is now known as green hydrogen.

Coordinated EU/multinational research and innovation support for heavy-duty road vehicles and long-haul transport. Various strategic and governing documents reflect the expectation that hydrogen will have a higher potential in these two applications.

Equilibrium in the hydrogen market. By 2045, it is expected that there will be very few innovations in hydrogen production and utilization, while at the same time, the market’s growth will be stable. For new or adapted businesses, this means that their products and services will have a stable client base.

Electricity price volatility. It is expected that hydrogen helps to balance the electricity system to be strongly based in the future on abundant, cheap renewables (solar and wind), which are intrinsically volatile. Balance the system in this case means that when there is a low in electricity production, fuel cells using hydrogen will produce electricity using, for example, Proton Exchange Membrane Fuel Cell⁹ (#PEMFC) produces electricity from the chemical reaction between hydrogen and the air (or other gases) and generates water as a by-product. PEMFC technology is very well suited to accommodate the intermittency of energy supply associated with renewables.

Future expected hydrogen production

PEMWE stands out among the hydrogen production technologies due to its high production rate of pure hydrogen and high energy efficiency. Hower the hydrogen market is not a mature market and new innovative services and new technological disruptions should continue happening for example, reducing the use of rare earth materials¹⁰, improving cells architecture and materials’ properties.¹¹

The main components and materials of Proton Exchange Membrane (PEM) technologies such as PEMFC and PEMWE are¹²:

- Ion exchange membrane as solid electrolytes. The ionic conductivity is the most important feature of the slot-die-coated solid polymer membrane. It should be durable, robust, and resistant to chemical attack at a wide range of operating temperatures.

- Catalyst layers. Its function is to initiate the electrochemical reaction. It can be slot-die coated on the Ion exchange membrane. When the ion exchange membrane and the catalyst layer are commercially fabricated, they are known as membrane electrode assemblies (MEA).

- Electrically conductive, porous gas diffusion layers. This is the outer layer of the MEA, placed between the flow plates and the catalyst layer. Among other functions, it provides mechanical support, protects the catalyst layer from corrosion, contributes to heat removal, and helps disperse the reactant.

- Cell interconnects and flow/cooling plates. Deliver the H2 or water to reactive sites via flow channels and electrically connect the cells. They provide mechanical support for the cells in a PEMFC or PEMWE stack.

Massive infrastructure for hydrogen storage or transportation (pipes) must also be built, and the governing documents do not clear which option (hydrogen storage or pipelines) will be given priority.¹³ Decentralized hydrogen production is probably more strategic to be better prepared for more geopolitical disruptions.¹⁴

Actors in the hydrogen value chain ecosystem that by 2045 must adapt their business

Two distinct types of actors in the hydrogen value chain that would have a chance to adapt their business models for the forthcoming hydrogen market demands are hydrogen refueling station owners and hydrogen producers.

Notice that the reference paper¹ interviewed Swedish stakeholders. Similar results can be expected for other advanced economies. However, as mentioned earlier, the hydrogen market is not mature, meaning that we can expect disruptive hydrogen innovations from anywhere, and other actors could become more relevant.

Hydrogen producers can be the first movers to provide a “just-in-time” type of service. In 2025, we see that in some cases, for personal vehicles, a full recharge of hydrogen is faster than a full electric battery charge but is still more time-consuming than a petrol full recharge. It is not clear if the hydrogen will be produced on-site or delivered; in any case, in the framework of the existing technology in 2025, the hydrogen would need to be stored, promising a bright future for the existing hydrogen storage stakeholders.

Possibly, refueling stations will evolve to just-in-time production and customer delivery, skipping the expensive and resource-consuming storage step.

Water availability, sustainability, and parallel nonmain revenue streams (from selling oxygen and heat) should also be considered. Today in 2025, improved and harmonized safety standards, monitoring and assessing social and labor market impacts are needed to support policy making.

A future blog will cover securing the supply of critical raw materials in light of their increased demand by many different upcoming technologies.

This was 100% written by a human 🙂

References

- International Journal of Hydrogen Energy, Volume 98 (2025) 554–562 – Future business models for hydrogen in Swedish road transportation – H. Hansson, M. Särnbratt, N. Fransson, K. Sernhed, K. Lygnerud, M. Andersson

- European Commission. A hydrogen strategy for a climate-neutral Europe: communication from the commission to the EUROPEAN parliament, the council. The European Economic and Social Committee and the Committee of the Regions; 2020. COM/2020/301 final

- Global Hydrogen Review 2024

- Renewable Energy Directive

- European Commission, Renewable Energy Directive

- Hydrogen roadmap Europe – A sustainable pathway for the European energy transition

- Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on the deployment of alternative fuels infrastructure and repealing Directive 2014/94/EU of the European Parliament and of the Council. COM/2021/559 final.

- The Business Model of an Emerging Hydrogen Market in the Swedish Transportation Sector – outlook towards 2050. Mirjam Särnbratt et al 2023 ECS Trans. 112 471.

- Comprehensive review on the advances and comparisons of proton exchange membrane fuel cells (PEMFCs) and anion exchange membrane fuel cells (AFCs): From fundamental principles to key component technologies.

- NewHydrogen Announces Disruptive Technology to Produce the World’s Cheapest Green Hydrogen

- Anodes and Cathodes for Fuel Cells

- A. Baroutaji, J. G. Carton, M. Sajjia, and A. G. B. T.-R. M. in M. S. and M. E. Olabi, “Materials in PEM Fuel Cells ,” Elsevier, 2016.

- European Commission, Delivering hydrogen to EU’s industry: which are the greenest options?

- Irena, Geopolitics of the Energy Transformation

Read more on the topic

Download the FOM Technologies Product brochure